JPMorgan

project description

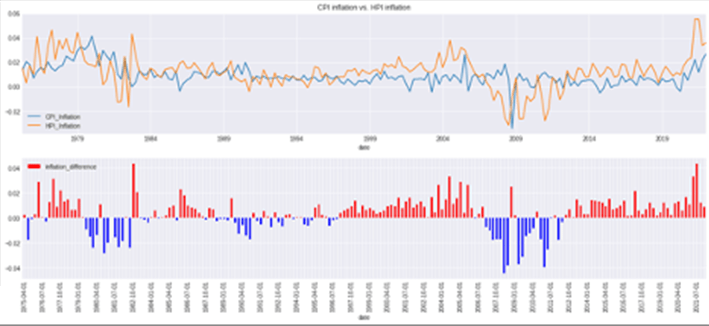

Determine drivers of home prices in Metropolitan areas (MSA’s) in order to identify MSA’s with the potential for the highest amount of dynamic growth over the next five- to ten-year period. Our approach to this project has been to use home prices as our target feature (Home Price Indices are provided by the Federal Housing Finance Agency for 383 Metropolitan Statistical Areas within the United States) and approximately 30 economic, demographic, and financial features to determine drivers and leading indicators of long-term home price movements in each metropolitan area.

Throughout this project, we have continually found that high-level data (GDP, population, inflation, interest rates, etc.) are insufficient for understanding the nuances of housing markets. As a result, our work has involved a tremendous amount of problem structuring to better recognize important market drivers and players at a tremendous level of detail, allowing for a much deeper appreciation of why markets move and how we can predict those moves with a high level of accuracy.

For a large real estate organization or bank like JPMorgan, knowing which markets are prime for growth and the behavior of some markets compared to other markets can prove extremely valuable for asset allocation decisions within their various portfolios.

Previous

Next